Content marketing isn’t all sunshine and rainbows.

Sometimes it is – the creative ideas flow, are fun to produce, and perform well.

But sometimes it feels like you’re in a bit of a rut – the ideas are dull, you don’t think they’ll provide real value to the audience, and it feels like all your competitors are just producing versions of the same content.

In those moments, original research content may be the answer to your prayers.

Original research content surfaces fresh insights and angles that set your brand apart. It lends itself to creative distribution campaigns and big brand moments. And the data-led stories that are uncovered are perfect fodder for repurposing into standalone content pieces – giving new fodder for your content calendar.

Think it might be just what you need?

Then let’s explore further:

- What is original research in content marketing?

- Should you include original research content in your content plan?

- How to create and distribute original research content: a step-by-step guide

- Top tips for running a survey

- Should you gate original research content?

What is original research in content marketing?

In content marketing, original research refers to a bespoke piece of research being undertaken for the purposes of creating content based on the findings of that research. The resulting content often takes the form of a research report, such as Buffer’s ‘State of Remote Work’.

The main ways to produce original research are:

- Proprietary data analysis. Many tech companies own data as part of their product, which may include compelling findings for content. Ravio, for example, has an extensive database of compensation benchmarking data, and they release key trends from this data in their annual compensation trends report. Even tech companies that don’t explicitly sell data as part of their product may still have proprietary data in terms of how customers use the product – Gong, for instance, regularly publishes findings from analysing how sales teams use their sales platform, through the Gong labs series.

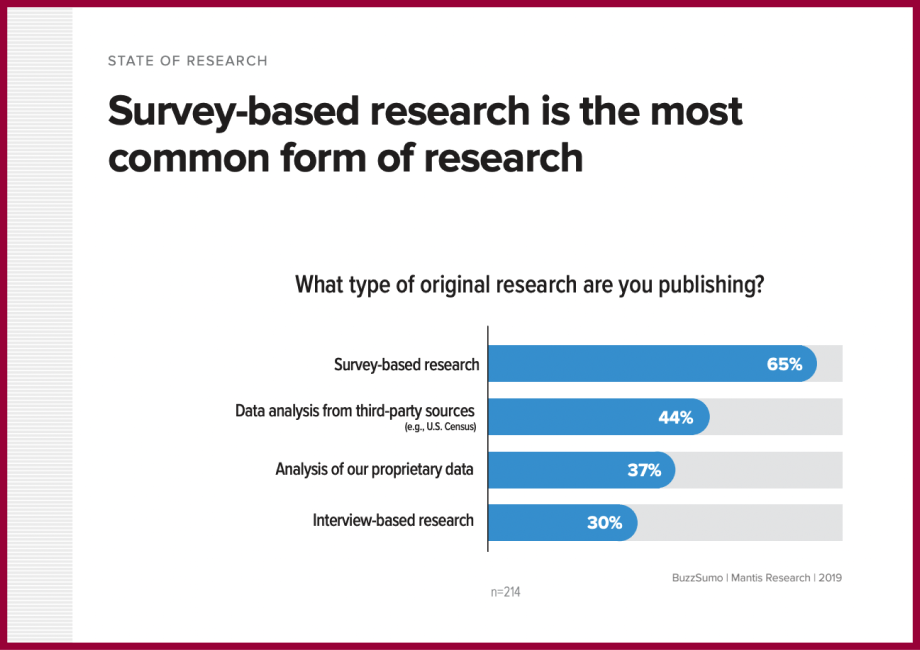

- Market survey study. According to a Mantis Research report, survey-based original research is the most common type amongst marketers, wherein a survey is conducted and key findings and trends from the responses are published. An example of this is Lattice’s annual ‘State of People Strategy’ report.

- Third-party analysis. Instead of analysing your own proprietary data, collect existing external data to analyse. A marketing company, for instance, could analyse the homepages of 100 tech companies and share key themes and findings. One example of this is Kamma’s ‘State of the Climate Transition’ report which analyses the transition plans of 85 UK mortgage lenders.

- Experiment findings. Some products lend themselves to running mini-experiments and publishing the findings – if you had a marketing platform product, for instance, you could run A/B test campaigns testing different variables and publish the findings. Another example of this is Stripe running an experiment to find out if adding a ‘buy now, pay later’ option to checkouts adds friction.

Should you include original research content in your content plan?

Probably!

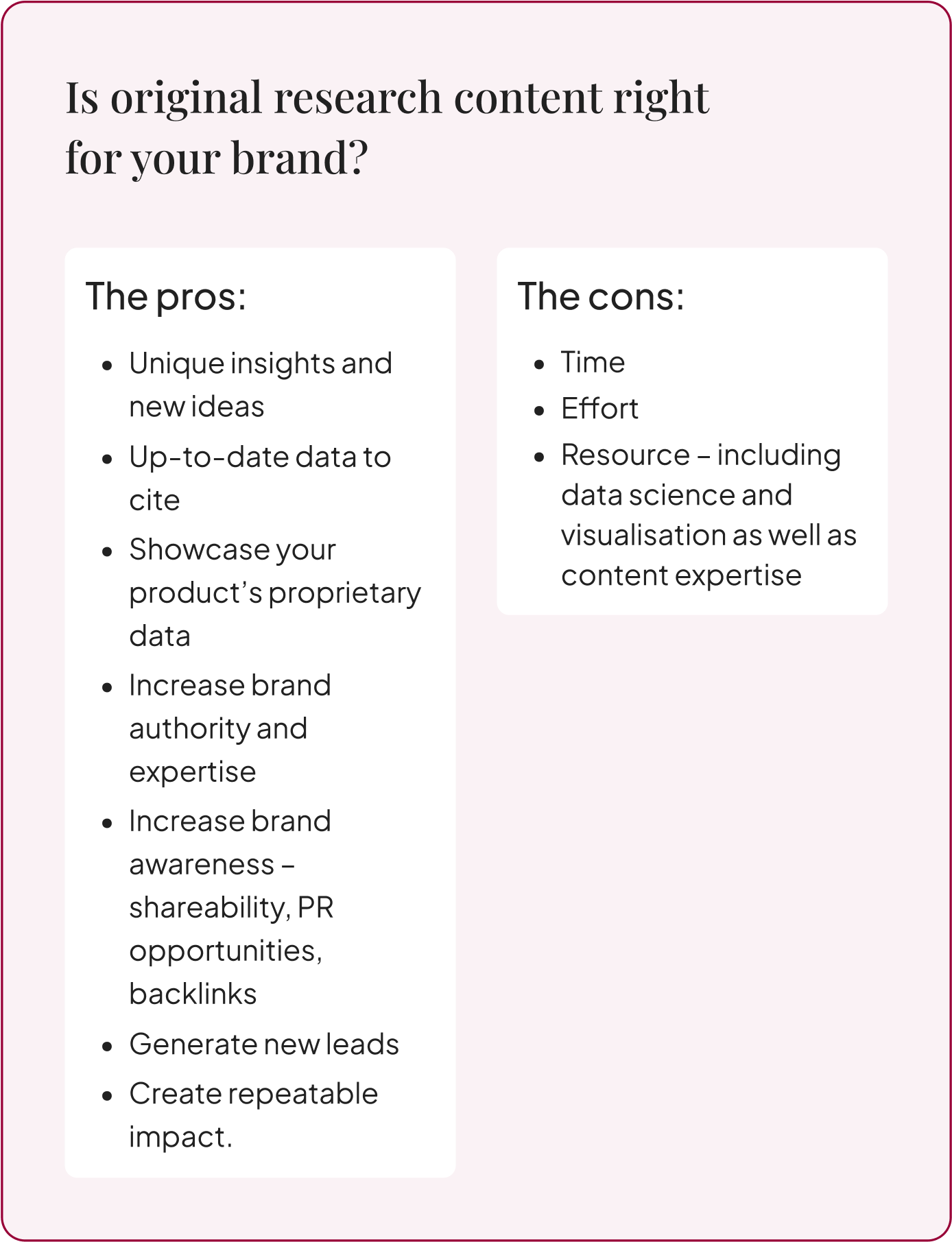

Original research content has lots of benefits and a few downsides.

Here’s a quick snapshot of the pros and cons:

Now let’s take a closer look at each of these.

In terms of the benefits of including original research in your content plan:

- Unique insights and new ideas. It’s easy for content to feel stale when it relies largely on desk research. Original research projects give you data findings that provide unique insights and new angles to create truly differentiated content around.

- Up-to-date data. Great content provides evidence for the arguments made. But how many times have you gone to cite a study or research paper, only to find that it was conducted 5+ years ago? Outdated data damages the credibility of the argument. Original research projects give you up-to-date data to cite for the most important arguments in your content plan.

- Demonstrate brand expertise. Producing original research content with those unique insights places your brand as a thought leader and authority for the topic area that your research focuses on.

- Showcase your data (if applicable). In some cases original research content showcases data that is available as part of a product – like Ravio’s Compensation Trends report, for instance, which includes a round up of key trends from their compensation benchmarking database. This can be a great way to show potential customers the kind of insights that can be gained through buying your product.

- Shareability and backlinks. It isn’t just you that wants up-to-date data to cite. If the original research content you produce is relevant to your industry, you’ll find that it gets shared and cited broadly. That increases the reach of your brand, as well as improving SEO performance by boosting the number of backlinks to your domain.

- PR opportunities. Journalists love new data findings. When you produce original research content and turn the findings into a great press release, you’re almost guaranteed to gain brand exposure through press and media, which may even lead to speaking opportunities on the topic at hand.

- Increased brand awareness. Publishing original research content is a great way to engineer a big brand moment. The attention surrounding the launch of the original research content (PR, shareability on social media and other channels, increased branded search, etc) makes your brand visible to new audiences.

- Generate new leads. Done right, original research content provides a huge amount of value through new insights and fresh data findings. It, therefore, makes for great gated content because it actually delivers enough value to be worth giving away your email address for. That can help to generate a new pool of potential leads to warm up and nurture over time.

- Repeatable impact. Original research content makes for perfect repeatable content. If the content performs well (in all of the ways listed above), it can be repeated the following year to produce updated data on the same topic. This gives the opportunity to build on the content, adding new insights based on feedback from the market. It also gives the opportunity to start building trends by comparing the new data to that from the previous year. In this way, original research can become a reliable annual brand campaign, becoming a known touchpoint that your audience looks out for each year. Ravio’s Compensation Trends report, for instance, began for 2024 and now has a 2025 edition too.

However, there are a couple of important considerations to make if you are thinking about adding original research to your content plan:

- It needs to be high-quality to be successful. Half-hearted original research content isn’t going to work. It needs to provide genuinely interesting data that unearths new insights or challenges existing ones.

- That takes a lot of time, effort, and expertise to get right. Ensuring original research content is high-quality isn’t an easy feat – you need to have the time and resources to get it right before embarking on an original research project.

- Including data science expertise. Great original research content relies on data analysis and data visualisation. You need to ensure you’re asking the right questions, interpreting the data correctly, and communicating the findings in an understandable way. It can’t be just a content marketing project, it needs collaboration with data science and design colleagues. If you don’t have that at hand, you’ll need to source support externally, or leave original research ideas until you do have the internal resource to make it work.

Your content shouldn’t sound like every one of your competitors’.

With my Content Strategy Audit you’ll identify the creative content opportunities that competitors can’t replicate, and that will truly build brand authority.

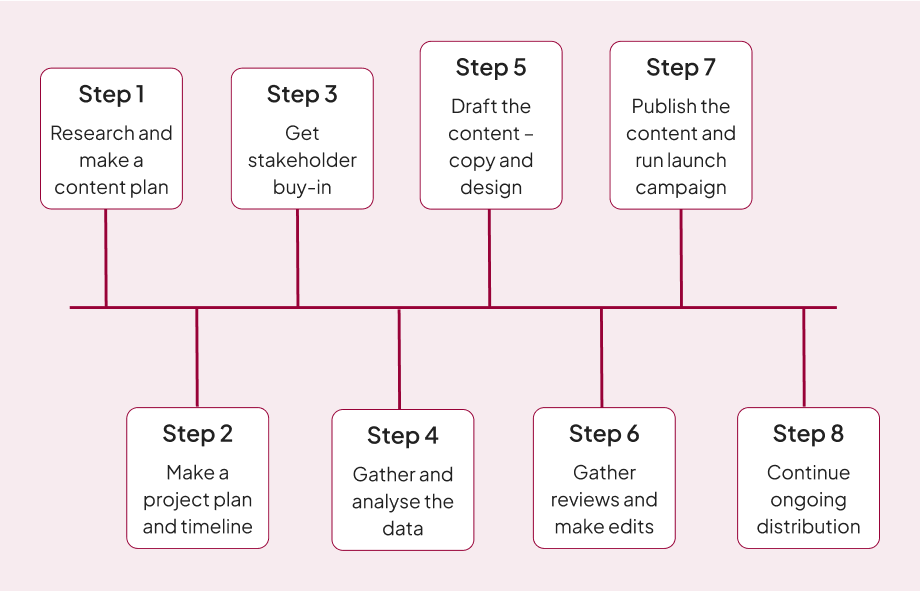

How to create and distribute original research content: a step-by-step guide

How do you actually go about creating a piece of original research content? Let’s take a look at the key steps involved.

Step 1: The content plan

Original research content is time-consuming to produce, so it’s important that it has the impact that you want it to.

That means starting with research and a content plan:

- Target audience. Which of your buyer personas are being targeted with this piece of content? Why is original research content the right format for them?

- Topic. What key pain points and needs does the target audience have that original research could be harnessed to address? What questions are they asking us that we don’t currently have the answer to? Are there any emerging trends in conversations with customers or prospects?

- Competitor analysis. What research studies and content already exist on this topic area? What unique angles or insights could we add to this?

- Objectives. What do you want to achieve through this piece of original research content e.g. increased brand awareness, lead generation? What wider business goals are being driven through the project?

You’re looking for a topic area that is meaningful to your audience, isn’t completely saturated in the market already, and lacks evidence or data for common opinions or debates.

I recommend putting all of this information into a one-page strategy document that covers the aims and objectives, target audience, the pain points being addressed, the expected themes, and a brief explanation of how the original research will be produced and used.

It’s useful to have all these key elements in one clear place for a few reasons: for yourself to refer back to to maintain focus throughout the project, to make briefing collaborators and partners easy, and to support stakeholder alignment conversations (see step 3).

Here’s an example of how this thinking goes in reality.

Example: Kamma’s climate transition plan analysis

I worked with Kamma on an original research project to produce an analysis of mortgage lender transition plans.

Kamma wanted to own the topic area of ‘climate transition plans’ for their target audience of UK mortgage lenders – with the aim of increasing their brand awareness as experts on this subject.

I repeatedly heard from customers and prospects in this target audience that there was a huge pain point involved in producing a climate transition plan for the first time.

Sustainability Managers were going into the process of creating a transition plan blind. They’re a relatively new concept, and in most cases the Sustainability Manager was working alone on the project. They desperately wanted to know how other organisations were approaching this to know if they were doing the right thing, but there was a lack of transparency in the industry which left them unsure how to create a credible transition plan.

In terms of competitor analysis, there was a lot of educational content out there about transition plans, as well as best practice frameworks from organisations like Transition Plan Taskforce (TPT). But there was a distinct lack of data and insight on how companies (including mortgage lenders) were actually putting that advice into practice.

So, we had the perfect combination for a strong original research content project: a clear pain point from the target audience, and a topic area that is underserved with data insights.

The result was a report titled ‘The State of the Climate Transition for UK Mortgage Lenders in 2024’, containing two key pieces of original research. Firstly, the report centres around an analysis I conducted of 85 mortgage lender transition plans, against a set of criteria that make for a robust and credible climate plan. Secondly, it also includes findings from survey responses by ESG and Sustainability professionals in the mortgage industry, to bring qualitative insights too.

✨ Explore more original research content examples

I always find that looking at examples of how other companies are doing content helps me to understand different approaches and get inspired.

So, I’ve put together a set of original research examples to help you do just that.

Go to the examples >

Step 2: The project plan

Once you have the rough plan and objectives for the content that will be produced, it’s time to create a project plan.

Original research content takes a lot of time to get right and will involve several collaborators and stakeholders, so a strong project plan is vital – for original research content you need to be a great project manager as well as a content creator.

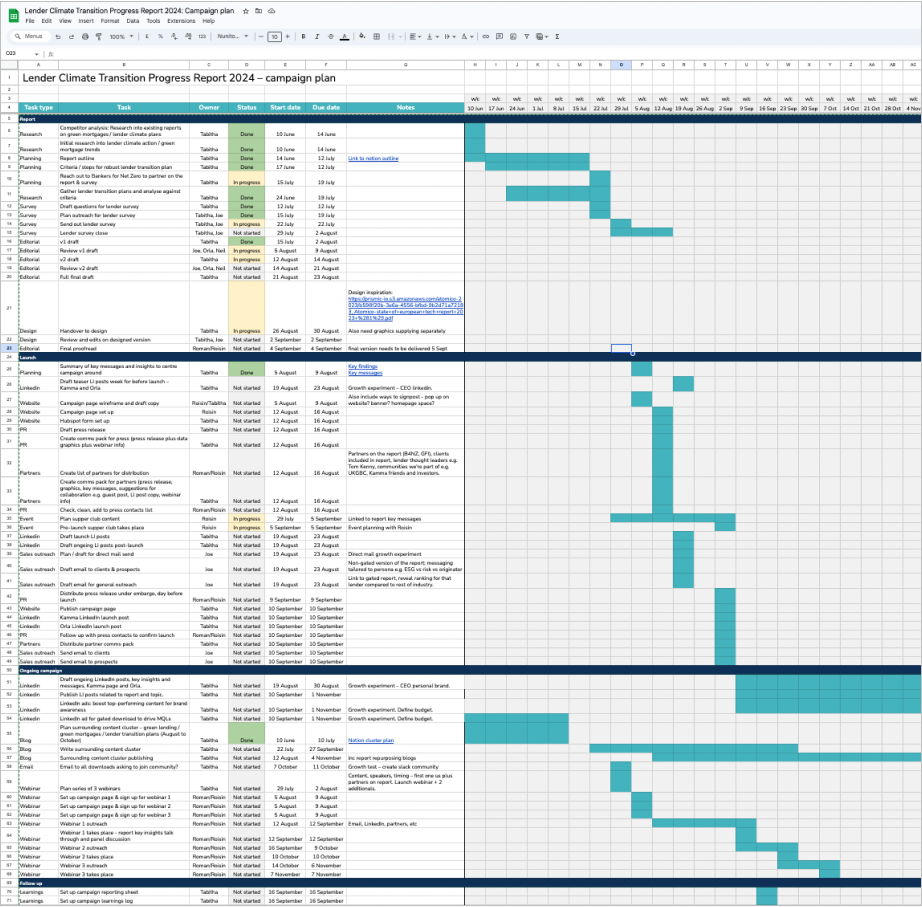

I recommend a Gantt chart style plan.

List out all of the tasks required to create, launch (see step 8), and distribute (see step 9) the original research content.

Then put those tasks against a timeline with how long each will take, and what the eventual publication or launch date will therefore be.

Make sure to highlight any important dependencies – tasks that will be delayed if other tasks are not completed in time.

Give each task an owner too so that it’s clear to all involved in the project who needs to be doing what, by when.

This project plan will be a living document throughout the production and launch of your original research, a project management tool to keep things on track.

Spreadsheets are always a great shout for this:

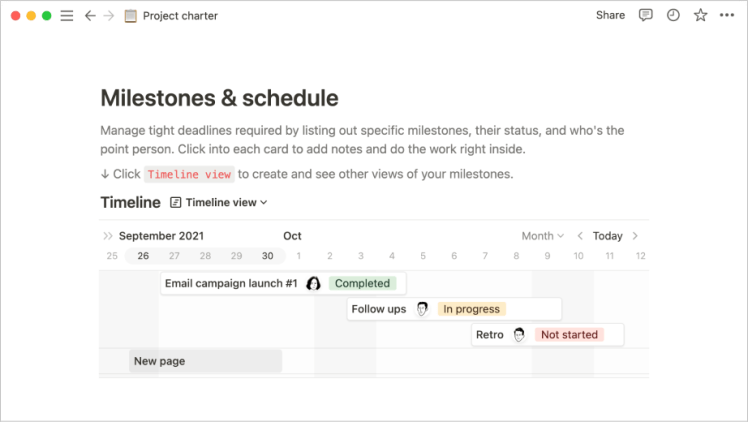

Or you could use a tool like Notion:

Step 3: Stakeholder alignment

Now that you have the strategic thinking on what the original research content should be, and the project plan that covers the details, it’s time to get stakeholder alignment.

I can’t stress enough just how important this step is.

Original research content projects tend to be pieces of content that have a strong viewpoint or challenge the status quo. They also tend to be more visible than your average blog, because you typically use them to make a big brand splash via PR and other channels.

For these reasons, internal stakeholders will definitely have an opinion on how the original research project should be run.

There’s nothing worse than getting stuck into the project and then finding out that your CEO thinks it should be done differently.

Plus, those internal stakeholders normally have strong networks, and you’ll likely want to harness that network to gather insights and/or to support the launch and distribution of the findings, so it’s good to get their buy-in and support early on.

Internal stakeholders also includes any team members that you will need to be involved in the project – data science, designers, etc. This is the opportunity to make sure the timeline works for them, and identify any elements or ideas that you’ve missed.

I’d recommend setting up a meeting with all the stakeholders, to run them through your strategic document as well as the planned timeline and ensure alignment. Then set up separate calls with each key collaborator e.g. data science, design, etc to go into the details.

Step 4: Data gathering and analysis

Original research isn’t original research without gathering data.

If you’re using proprietary data from your own product, this will be where that collaboration with your internal data science team comes in – to pull the data needed and to analyse it to find key trends and insights. It’s important that you tell an accurate story, not the one that you want to see.

It may also be that you’re working with a partner as a data provider, in which case this step involves all of that liaison with them to get the right data to include.

If you’re conducting a survey, this step is even more important, because the quality of the content rests on the quality of the survey questions and the number of responses received.

A piece of advice: be open to whatever insights and trends arise. If you try to create a piece of original research that ‘proves’ an opinion your brand already has, you’re missing the point. You can’t control the data or the survey responses that you receive (and if you do, it will be obvious that the methodology is dodgy as hell). New angles and ideas are incredibly valuable, so be open to whatever comes of the research.

💡 My top tips for running a survey

I’m no market research expert, but I have run a lot of surveys in my time to gather data for original research content.

Here’s all my best pieces of advice:

- Minimise open-ended questions. It’s always tempting to include lots of open-ended questions that require text-only answers. Whilst this can give great insights and quotes to include in the content, it also means that there’s lots of qualitative data which can’t be used to formulate key statistics and data findings.

- Avoid leading questions. The survey questions need to be as clear and objective as possible, to ensure that the answers received are honest and unbiased. If you write questions hoping to get a specific response back, you’re only reducing the credibility of the resulting data.

- Include demographic questions. The demographics of survey respondents will often impact the answers that they give – factors such as age, gender, location, company type, etc. It’s important to include these so that you can understand how they impact the results. Plus, this is also where you’ll gain additional segments to analyse the data against. For instance, you might find that there are very different trends at play in the responses from employees at early-stage startups compared to those at established public companies – and that’s always valuable insight to point out.

- Prioritise sample size. The number of respondents to your survey is important, because you need a substantial sample size for the findings to be statistically significant. Use a tool like Surveymonkey’s sample size calculator to find out how many responses you should be aiming for as a bare minimum.

- Make a survey distribution plan. As we’ve seen, getting a substantial number of survey responses is vital to success. Spend time thinking about how to maximise this. This might involve working with partners to distribute the survey more widely. Or it might include putting budget behind it – paid ads, an incentive e.g. gift card competition for completing the survey, or paying for additional responses using a tool like Pollfish.

Step 5: Content draft – copy and design

With the findings determined, it’s time to get drafting.

If you’ve had a rocky ride up to this point in terms of stakeholder alignment, I’d recommend first putting together a content outline which defines how the piece of content will be structured, the data findings that will be included, and the key themes or narratives that the content will focus on. Get the stakeholders to check the outline and add any comments before you start drafting the full piece.

Structure and data visualisation are key when it comes to quality original research content.

They tend to be pretty meaty pieces of content, often a lengthy data report or white paper, so the structure is important to ensure that readers can navigate through the report and easily find the data findings that interest them.

Great data visualisation ensures that the findings and insights that you’re surfacing are clear and easy to understand for all readers – and gives you beautiful, shareable assets that visually tell the narrative of the key findings to use throughout the launch campaign.

I’d recommend viewing this content drafting phase as a collaboration between content writer and designer. The structure and visualisation is never going to be on point if the designer simply receives a big old Google Doc with the copy. They need to be involved in how the data findings are turned into content – the visual and the written need to be aligned. This is especially important if you’re planning to produce a landing page or microsite as the key asset, rather than a static PDF or article.

Step 6: Content review and edits

There are likely to be lots of people involved in the review process – all those internal stakeholders, plus any external partners or subject experts that you want to gather opinions from.

This is always a frustrating part of the content creation process, managing an influx of comments and trying to keep on top of the timeline.

My best piece of advice is to build in way more time than you think you will need for reviews and edits. In my experience, that wiggle room is always needed.

Step 7: Publication and launch campaign

Publication time!

The launch of the original research content is key to making it a big brand moment – so it’s important to include the thinking on how you will launch the piece in the project planning phase (see step 2) to make sure you have everything ready at the same time.

This will likely include:

- Landing page – copy, design, development. If you’re gating the content, then this should include a snapshot of key findings and the form to download the full report. If you aren’t gating, then the landing page might be the bulk of the content itself, hosting all the key findings in a format like Klarna’s annual ‘The Checkout’ report.

- Teaser posts leading up to launch. This can be beneficial to build momentum and anticipation for the release of the report – on whichever channels are important for you.

- Network comms. To maximise reach it’s always worth engaging your wider brand network with an ask to share the report with their audience – partners, collaborators, friends – both those of the company as a whole and of key employees. Create a communications pack which contains draft copy for sharing the report via email and LinkedIn post, as well as graphics to share too.

- Share and engage via all your key marketing channels. Prep copy and imagery for announcing the report release via all the channels you use: email, social media, website pop ups, communities you’re part of, a launch webinar or in-person event, and so on. If momentum picks up and people are talking about the report, engage with it.

- Press release. Original research is great for PR, because journalists love to share new insights and data findings, so have that press release ready to go – ideally share the report with them under embargo the day before launch.

- Employee advocacy. If you have employees who are active on key channels such as LinkedIn, work with them to prepare a series of posts highlighting the launch.

💡 To gate, or not to gate, that is the question

Should you gate the original research content, or not?

It’s a good question, and it all depends on your goals – which should have been defined back in step 1 of the process.

If the priority is brand awareness, increasing website traffic, or improving SEO performance, then don’t gate the content. Having the content freely available on a webpage will be beneficial for all these aims – search engines will be able to index it and there are no barriers to your audience interacting with the findings.

If the priority is to generate new leads that can be nurtured and warmed up over time to become a potential buyer, then gating the content is worthwhile to support this aim.

If you do choose to gate, I’d always recommend building additional content around the gated piece to maximise brand awareness and SEO benefits at the same time – create standalone blogs that showcase key findings and themes, build snapshots of the data into the landing page where users can download, share key findings across other channels, and so on.

Step 8: Ongoing distribution

It’s easy to launch the original research and then consider it done.

But, a lot of time and effort has gone into the creation of this piece of original research content, so you want to squeeze as much impact out of it as possible.

So your project plan (see step 2) should also include the campaign plan for the ongoing distribution of the original research.

This should always include:

- Drip feed insights across key channels. Every single one of those data findings or survey questions tells a story, so continue sharing them across all key channels – including supporting employees and partners to draft posts sharing insights too. And don’t forget to make use of those beautiful data visualisations too!

- Surrounding topic cluster. If SEO is an important channel for you, then I’d highly recommend building the original research content into a wider topic cluster to help build topical authority and drive organic traffic to the report.

- Repurpose into other formats. Take the key stories and findings from the original research content, and turn them into standalone pieces of content – blogs, a webinar series, sales enablement collateral, tools (like this landing page, for instance) etc. As an example, following the launch of Kamma’s climate transition plan analysis, I published four blogs which each repurposed a key theme of the report into a standalone narrative and targeted a relevant keyword: the top 5 lender climate plans in 2024, climate data quality is the biggest barrier, how to reduce financed emissions as a lender, 5 essential steps for SME lenders.

- Nurture leads. If you’ve released the original research as gated content, then make sure you have a plan for how you will nurture the leads gained from content downloads.

🚀 Outsource your original research content

We’ve seen throughout this article that creating high-quality original research content is no easy task.

Working with a freelance content writer who has experience with working with original research content can take the pressure off, freeing up time for your marketing team to focus on everything else that’s on their plate.

Get in touch

3 thoughts on “How to create compelling original research content ”

Comments are closed.